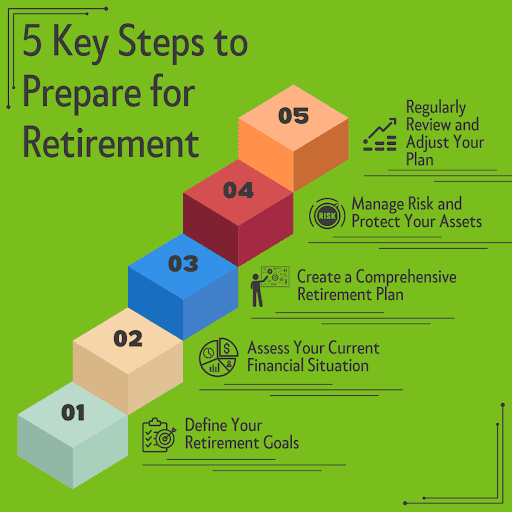

5 Key Steps to Prepare for Retirement

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

There are two common traits among successful retirees: they started saving early, and they have a plan. However, there’s an incredible amount of nuance involved in everyone’s life. Doing the wrong things early or executing on a poorly made plan doesn’t help anyone.

A well-tailored retirement plan, focusing on the most important aspects of your life, can provide financial security and peace of mind. Retirement planning isn’t a one-time event but a continual process which grows and moves with you. Let’s go over the five main steps needed to prepare for retirement.

Step 1: Define Your Retirement Goals

Most of us have a general idea of what we might want to do in retirement. However, once we get closer to retirement, things can look a bit different. The entire concept of being retired starts to feel more real (and maybe a little stressful).

It’s important to set specific, measurable, and realistic goals. More importantly, you need to uncover the most important things in your life and start putting some numbers to things. The money piece is largely just a math problem, which is much easier to solve.

Defining Your Retirement Lifestyle

The harder part is deciding things like the retirement lifestyle you want, when you want to quit working (or if you want to quit working), and deeper considerations around your legacy. You’ll need to answer questions like:

- Do you want to travel?

- Are you going to move or make other major changes in your location?

- Will your spouse retire at the same time?

- What will you regret not doing in retirement?

Once you know what you want, we can estimate how much everything might cost. You’ll want to get as specific as you can here. For instance, the goal of “traveling more” needs to be more clearly defined. You can give a range of costs, how you’ll travel, who you might want to take with you, how many trips per year, and more.

The more specific you can get, the better.

Step 2: Assess Your Current Financial Situation

Once you know what you want, we need to uncover how much you can achieve based on the resources you have available. It’s essential to have a clear picture of all your current savings, investments, and income sources. This includes accounting for any existing debt too.

You’ll also want to get a reasonable estimate of other retirement income streams, such as any pension income or your estimated Social Security payout. Although these may not cover all your needs, they are great additions to your retirement income.

Once you’ve determined your specific goals and the resources you already have, you can calculate the gap between your current savings and your retirement goals. Sometimes, you may need to adjust things to make it work. In some cases, you may be pleasantly surprised to find you have more than enough to accomplish everything you want in retirement.

Regardless, guessing isn’t an option. Knowing the resources are there to cover your goals gives you confidence to enjoy life in retirement.

Step 3: Create a Comprehensive Retirement Plan

If you identified any shortfalls in funding for your retirement goals, we’ll want to address those first. There are many different strategies to bridge financial gaps in your plan. However, you’ll need to decide what tradeoffs are worth it and which ones are not.

For instance, you might not want to work an extra year to make things work. Instead, you might prefer to take one less vacation per year or save extra in your 401(k) for the next few years. For some people, retiring early to pursue part-time work might be a better option.

It’s also important to diversify retirement investments. If your portfolio has a high concentration of company stock, it may be time to start moving into a broader mix of assets. Also, as you get closer to retirement, your investments’ job shifts from growth to preservation and providing retirement income.

Building Tax Efficiency

You also need to pay attention to the tax efficiency of your portfolio. For many retirees, large traditional 401(k) or IRA balances will be subject to required minimum distributions (RMDs). There may also be opportunities for tax-savings strategies like Roth conversions.

A tax-optimized retirement looks way better than “winging it” does. In many cases, you’ll need several years to implement long-term tax strategies. You also need to be aware of how different types of retirement income can affect other aspects of your life like Medicare premiums and taxation of your Social Security payments.

Step 4: Manage Risk and Protect Your Assets

One of the main concerns many retirees face is whether they’ll run out of money. Obviously, running out of money is bad. However, if you’ve developed a comprehensive retirement plan, you have a lot less to worry about, barring some major catastrophe.

Some of the biggest retirement risks include health issues, premature death, and economic conditions (such as market fluctuations, inflation, and legislative changes). However, you can protect yourself against all of these.

Proper Insurance Protection

It’s important to have the proper health, life, and long-term care insurance. In some cases, these aren’t necessary, but you never want to assume. We want to put numbers to your situation and determine if additional coverage is needed.

Your coverages will often change when you leave work, so you need to have a plan for things like health insurance. It’s also important to understand coverage and costs of Medicare.

Economic and Market Conditions

You can’t control when the next recession will happen. You also can’t change the rate of inflation. However, you can develop a rock-solid investment policy statement to decide how you’ll handle anything the markets throw your way.

We help clients develop their investment policy statement as a part of our initial plan-building. Having a clearly defined picture of your portfolio construction for retirement income is very helpful. When things get scary, it’s helpful to know exactly what you will and won’t do.

Adjusting for Inflation

Adjusting for the inevitable creep of inflation is also especially important. Every plan should factor rising costs into the equation. However, don’t just focus on the normal metrics for inflation like the consumer price index (CPI).

You’ll want to keep an eye on inflation for some of the costs most important to your goals. For instance, if funding college for your children or grandchildren is important, keeping track of college tuition costs would be important. Once again, your retirement plan is specific to your life and goals.

Estate Planning

You’ll also want to protect your assets as they pass from you to your heirs. From designating beneficiaries to establishing trusts, there are many considerations. There’s no one-size-fits-all solution to estate planning.

In many cases, what we want changes over time, but the proper legal documents to ensure our wishes are carried out get neglected or forgotten. Make sure everyone knows the plan, but also make sure everything is properly documented.

Step 5: Regularly Review and Adjust Your Plan

Life is full of changes, and retirement is no different. Financial planning isn’t a one-time event. As your situation changes, you’ll want to review your plan and make adjustments along the way.

As you experience life changes through career shifts, family changes, and maintaining your health, you’ll need to revisit things. This is where working with a financial planner can be a real value add. Having a trusted professional who can help answer questions and look out for you is invaluable.

As laws, markets, and life changes happen, a good financial planner can help you navigate them and keep you focused on the things you really care about like family and friends.

Build Your Retirement Plan Today

In closing, we can’t overstate the importance of proactive retirement planning. Starting early, staying disciplined, and seeking professional advice can be invaluable. If you’re feeling “behind” in your planning, it’s not too late.

No matter what age you are, you can take the first step toward a secure retirement today. We’d encourage you to take some type of action toward building your retirement roadmap. Build your retirement team and design the retirement of your dreams today!

This article reflects the insights and opinions of its author and is not a recommendation or endorsement of their views or services.