Biden’s Top Economist Flips On Debt Crisis. Blames Trump After Years Of Supporting The Same Policies – Financial Freedom Countdown

In a dramatic reversal, Jared Bernstein, the former chair of President Biden’s Council of Economic Advisers, now warns that America is on the verge of a full-blown debt crisis.

After decades of downplaying deficit concerns, Bernstein is sounding the alarm in a new New York Times op-ed. But critics argue his timing and finger-pointing raise questions.

From Deficit Dove to Fiscal Hawk: What Changed?

Bernstein, a lifelong “budget dove,” admits that the math has changed.

“No longer. I, like many other longtime doves, am joining the hawks, because our nation’s budget math just got a lot more dangerous,” Bernstein wrote.

Interest rates have risen sharply, now matching the country’s growth rate; a dangerous sign.

But his sudden concern comes just after years of Biden-era spending that helped push debt and inflation higher.

Interest Rates Rose Sharply During Biden’s Term

Bernstein says one chart convinced him: a graph showing that interest costs are overtaking economic growth.

During President Biden’s time in office, interest rates surged at a pace not seen in decades, largely in response to soaring inflation and expansive fiscal policy.

The Federal Reserve raised benchmark rates aggressively in an effort to cool down price increases. While these hikes were a response to macroeconomic pressures, critics argue that Biden’s multi-trillion-dollar spending packages; such as the American Rescue Plan and Inflation Reduction Act, helped fuel inflation, forcing the Fed’s hand.

As a result, the government’s borrowing costs skyrocketed, with the interest paid on federal debt rising to levels not seen since the 1990s, crowding out other budget priorities and accelerating concerns over long-term debt sustainability.

Blaming Trump While Overlooking Biden?

Bernstein singles out Trump’s tariffs and recent legislation as worsening the debt outlook. He warns that tariffs are pushing up inflation and deficits.

But fiscal conservatives point out that inflation and skyrocketing interest payments soared under Biden, whose own policies spurred massive spending with little budget restraint.

Although economist like Bernstein have been talking about inflation due to tariffs, it hasn’t shown up yet.

The latest Fed meeting minutes show FOMC policymakers projecting rate cuts in their summary of economic projections, known as the so-called “dot plot.” Members see two interest rate cuts in 2025, followed by one cut each in 2026 and 2027.

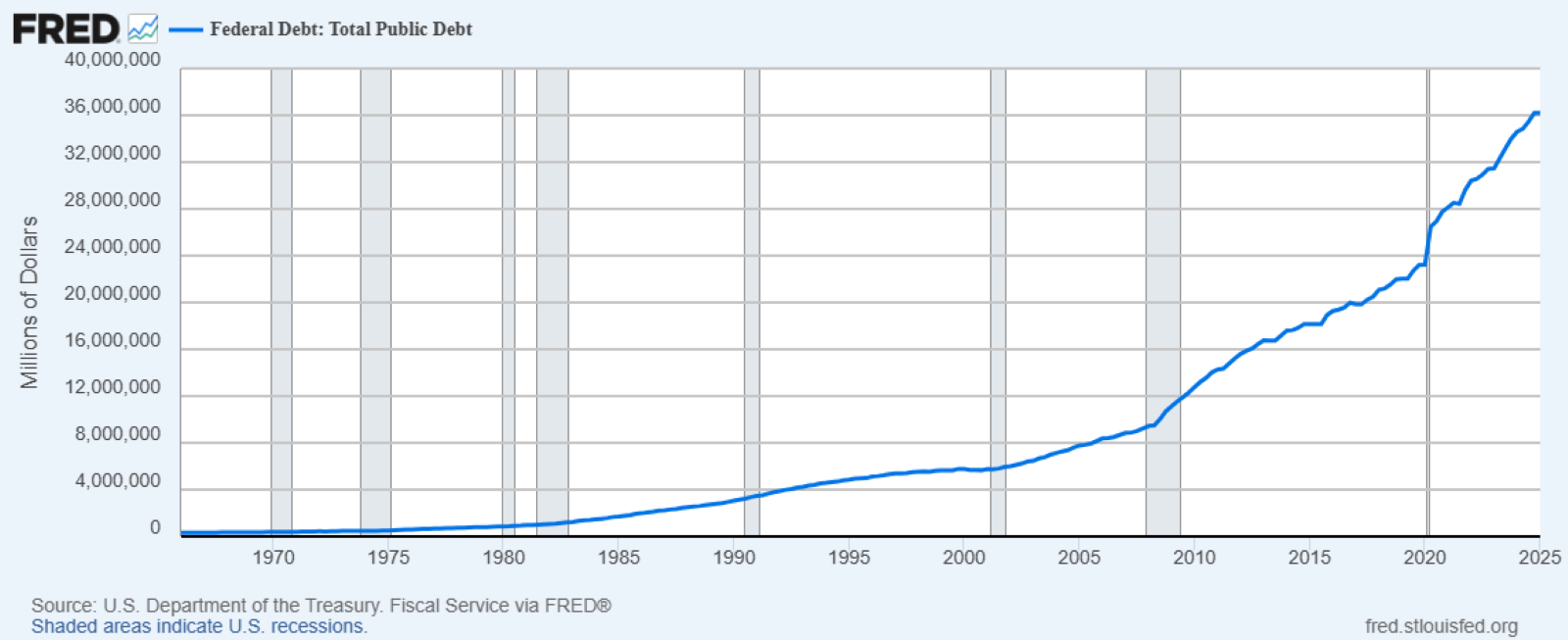

Debt Explosion: Interest Payments Now Rival Medicare

The numbers are eye-popping. The U.S. now spends more on interest than on Medicare or defense, and interest costs are set to hit $1 trillion in 2026.

Can Rising GDP Offer Hope?

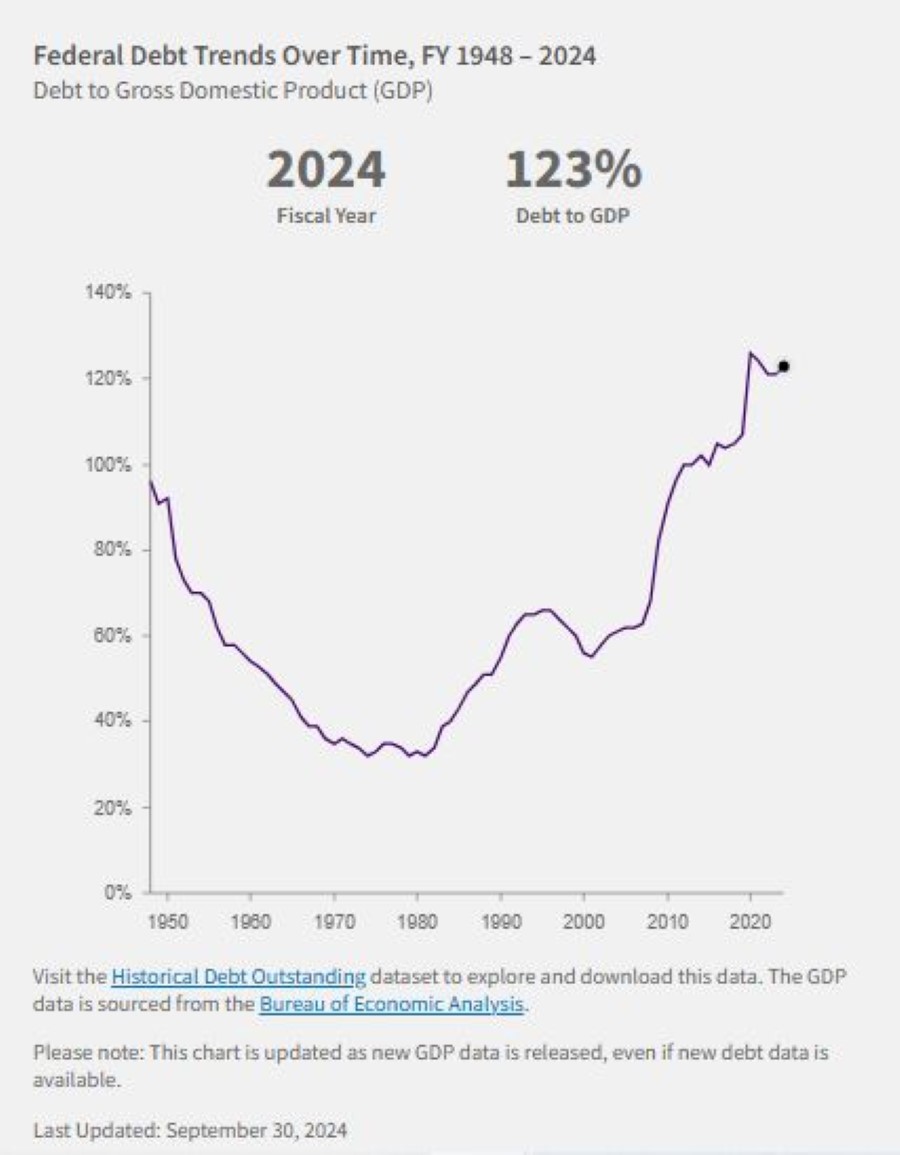

The Congressional Budget Office warns of a mounting debt-to-GDP ratio that could soon surpass World War II levels.

Comparing a country’s debt to its gross domestic product (GDP) reveals the country’s ability to pay down its debt.

This ratio is considered a better indicator of a country’s fiscal situation than just the national debt number because it shows the burden of debt relative to the country’s total economic output and therefore its ability to repay it.

The U.S. debt to GDP ratio surpassed 100% in 2013 when both debt and GDP were approximately 16.7 trillion.

The average GDP for fiscal year 2024 was $28.83 T, which was less than the U.S. debt of $35.46 T.

This resulted in a Debt to GDP Ratio of 123%. Generally, a higher Debt to GDP ratio indicates a government will have greater difficulty in repaying its debt.

Bernstein’s call for “break-glass” deficit plans and triggers sounds urgent; but critics note these are the same tools Democrats dismissed when Republicans called for restraint.

As one economist quipped, “It’s a lot easier to preach austerity when your team’s not in charge.”

Social Security beneficiaries are projected to receive a 2.6% Cost-of-Living Adjustment (COLA) in 2026, according to estimates based on the latest inflation data released by the Bureau of Labor Statistics on July 15, 2025. The adjustment, which determines how much monthly benefits increase to keep pace with inflation, is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While this projected bump is slightly higher than the previous month’s estimate of 2.5%, it still falls short of covering rising living costs for many seniors.

Social Security’s 2.6% Projected COLA in 2026 Could Be Wiped Out by Rising Medicare Costs

New Mortgage Rule Lets Renters Use Payments to Qualify for a Home. Trump-Appointed Housing Chief Says It Could ‘Unlock the American Dream’

A major shift in mortgage lending just arrived; and it could open the door to homeownership for millions of Americans. Under a new order from Federal Housing Finance Agency Director Bill Pulte, rent payments will now help Americans qualify for a mortgage. It’s a populist policy change aimed at rewarding financial discipline, restoring fairness to the credit system, and expanding access to the American Dream.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.